Homebuilders/construction cos+ semiconductor capital equipment companies - the good kind of cyclical

Cyclicality comes in different flavors. Some potentially poisonous, some very fruitful. Fortunately, the flavors are easy to identify if you know what to look for. Let’s look at some charts.

Here is Lennar’s LEN 0.00%↑ normalized EPS growth since 2014:

Lennar always has been and always will be cyclical. However, their cyclicality will also reliably be around a line that moves up and to the right. EPS doubled from the top of the last cycle in 2018 ($6.35) to the bottom of this cycle ($12.28), and as surely as the sun rises it will go on to new highs.

Idk if the next cycle will start in 2026, nor do I know when it will end. What I do know is that at $12.28 of EPS Lennar is currently at an Earnings yield of almost 12% if you strip out the cash. What I do know is that at some point it will have a new upcycle and earnings will hit new highs. Meanwhile, it has $4B of net cash on a $30.5B market cap - plenty of room to buy back stock while we wait for the good times.

Let’s do another. Here is AMAT’s (Applied Materials - the second largest semiconductor capital equipment maker by revenue after ASML, and the most diversified) historical and forward EPS estimates:

Semiconductor capital equipment companies are all supposed to be cyclical, and they are, but the secular tailwinds at this point are so strong that we’re barely even seeing EPS drops during the “down cycles”.

For AMAT 0.00%↑ EPS increased from $.90 to $3.23 during the first cycle; from $2.86 to $8.61 in the second cycle; and will start the third cycle at $8.24. There’s actually pretty good visibility into 2026 revenue already so the $9.92 they’re expecting probably gets hit.

Meanwhile, both homebuilders and semicap (abbreviation for semiconductor capital equipment companies) are run by veterans who understand how to take advantage of cycles to purchase shares at a discount.

AMAT shares outstanding are down by 32% over the period.

Margins for both semicap and homebuilders used to be far more variable than they are today. What’s changed? In both cases the past two decades have seen the markets consolidate. Homebuilders got out of the land speculation business. Semicap install base has grown and with it steady services revenue now accounts for a bigger piece of the total. Both groups of businesses have secular tailwinds.

DR Horton has grown it’s market share from approximately 0% to over 14% - building 1 out of every 7 homes in the US:

Lennar has seen similar and remarkable growth. Looking across the basket, major builders have consolidated the market to the point where they account for 60%+ of total new homes built. Their size combined with optioning rather than purchasing lots has turned them into capital light manufacturing businesses that just happen to “manufacture homes”.

DR Horton has higher margins than most due to its scale - but virtually all homebuilders - even the smaller regional players - have margin profiles that look more like cyclical manufacturers than the homebuilders of yore:

(In case the letters are too small - over the past 10 years DHR trough gross margins were 20.12% and peak were 30.08%).

Homebuilders will not grow as fast in the future as they did in the past, primarily because they already have so much of the market that there are fewer smaller builders to rollup and hence less consolidation ahead.

Semicap finished consolidating a decade ago - though that hasn’t stopped their phenomenal EPS growth thanks to the secular tailwind of humans needing ever more chips.

These are AMAT’s operating margins (not gross margins):

It’s absolutely wild that they maintained a 23% operating margin at the bottom of the last cycle, and even more wild that they will probably bottom out above 28% this year (another low). The biggest risk to semicap - by far without a close second - is China. Not only do they get a huge portion of their revenue from China - the more the US puts technology export bans on their equipment - the more incentivized China is to subsidize local competitors. Still, it seems ridiculous to me to believe that given the acceleration we’re seeing in AI that this rising tide will not result in still remarkable EPS growth moving forward.

The companies I’ve named are not anomalies. You can throw a dart at any company in either group and the story is similar. Here’s KLAC 0.00%↑ - my personal favorite among the semicap names (as a business, not at these prices though):

And how about those operating margins?

We’ve hit the point in semicap where the margins at the cyclical lows are still world-class. Once again - here’s what shares outstanding have done over the past ten years:

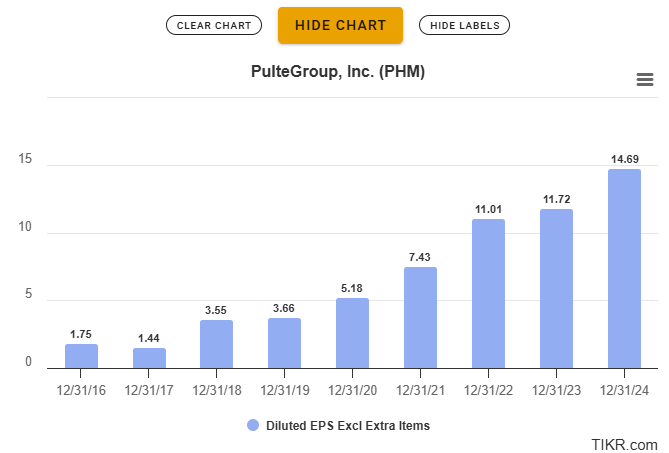

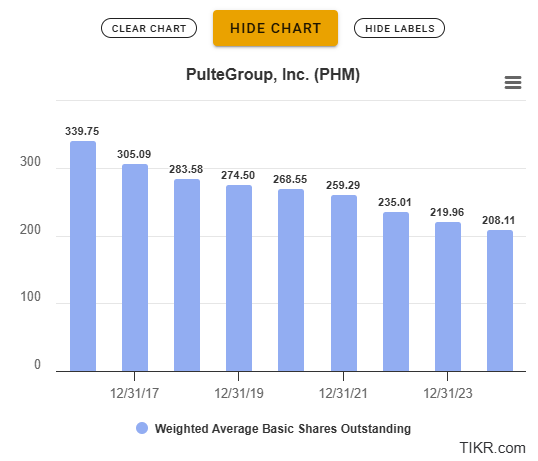

Here’s another homebuilder’s EPS growth - America’s third largest by completed homes:

And what a share cannibal they have been:

And here are Pulte’s historical and forecasted EBIT margins:

The largest holding of my [homebuilder/construction basket] is a company called St. Joe - but it’s a unique animal so I won’t get into in this post, but the second and third largest holdings are not actually homebuilders at all - but suppliers to the industry (in addition to supplying non-residential). They are Owens Corning and Carlisle.

OC 0.00%↑ has seen phenomenal EPS growth over the past ten years as it takes market share and rolls up smaller companies at low EBITDA multiples - which it immediately improves by centralizing operations and using their purchasing power to negotiate COGS down.

Here’s OC’s operating cash flow:

And yet again (it’s a theme, I know) we have a share cannibal:

Operating margin growth has been a thing of beauty:

The basic theme of this post should be clear by now. We have two cyclical industries (homebuilding/construction and semicap) - both with huge secular tailwinds. Margins, EPS, Cash flow etc are all cyclical - but cyclical around lines that are going up and to the right. Over time the cyclicality has decreased, and that should lead to multiple expansion in the future, meanwhile you have incredibly shareholder friendly management who will repurchase shares opportunistically (as opposed to companies who just buy no matter what the valuation is).

One thing an investor needs to keep an eye on is how good management is at predicting their own future. There is NO MANAGEMENT on Earth (probably?) who is as bad at predicting their own future as Snapchat. It’s hysterical listening to them talk about their business - you can just assume that whatever they think about the future the exact opposite will happen.

Across semicap and the homebuilder/construction basket, most management are top notch, grounded in reality, and pretty good at forecasting. In 2018 Carlisle laid out their “Vision 2025”:

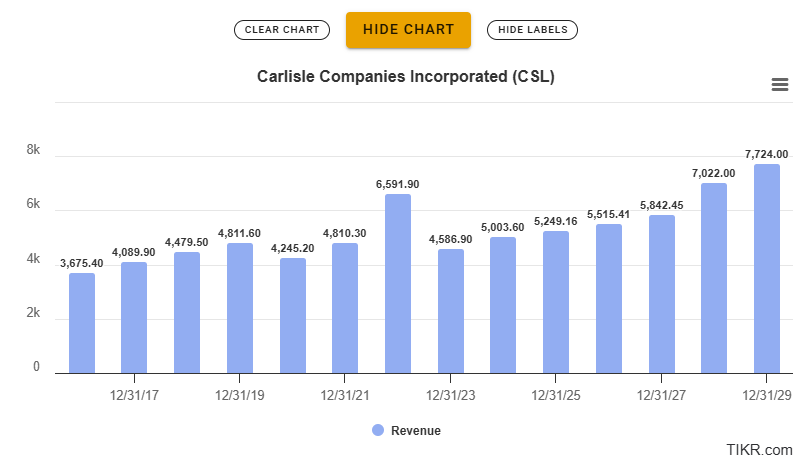

Let’s see how they did. Revenue first. In 2018 Revenue was ~$4.5B. It broke down as follows:

Of that $4.5 → $3B was in the construction materials business. Their revenue for 2025 is expected to clock in around $5.3B - all of which comes from the construction business b/c the other divisions were sold:

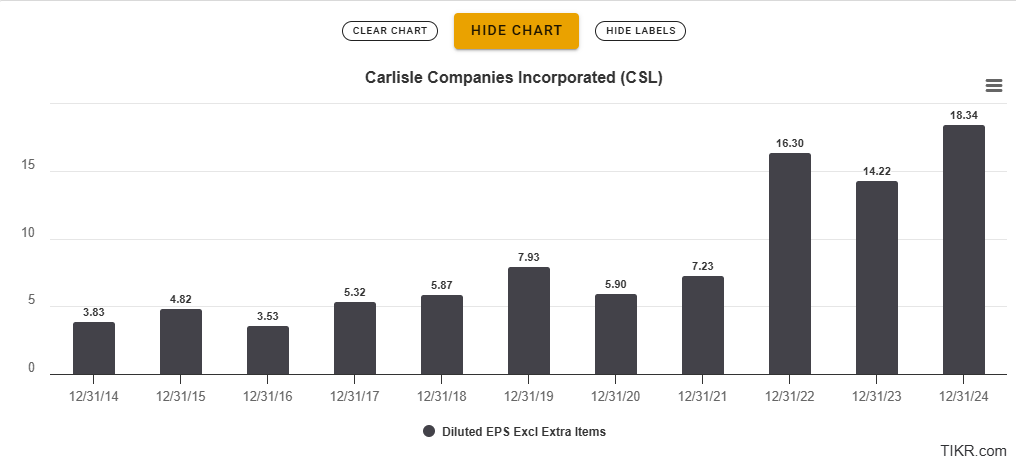

They didn’t hit the 2X, but 76% growth isn’t too shabby, and look what’s happened to margins and EPS:

Carlisle’s goal was $15 in EPS by 2025, they hit that goal in 2022. Their new objective for 2030 is to hit $40+ in EPS:

Carlisle is at $336 today. If they hit $40 in 2030 and trade at 15X you’re looking at ~12% share CAGR before taking into account shareholder distributions - which should clock in around 6% this year.

IMO the remarkable performance (shareholder returns) of these companies - both semicap and homebuilders/construction cos - is made possible by the cyclicality/uncertainty associated with their respective businesses. The market refuses to give them a multiple that would result in their long-term go-forward returns being more in line with the S&P500. For investors this is a gift, because the cyclicality isn’t the same as it is in the oil or coal industries - where downcycles can last decades and margins don’t go up from cycle to cycle.

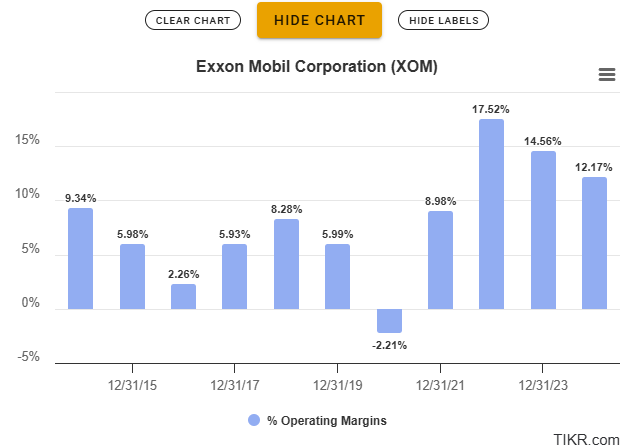

Consider as an example the margins of Exxon Mobile:

Or worse, a coal company like Alpha Metallurgical Resources:

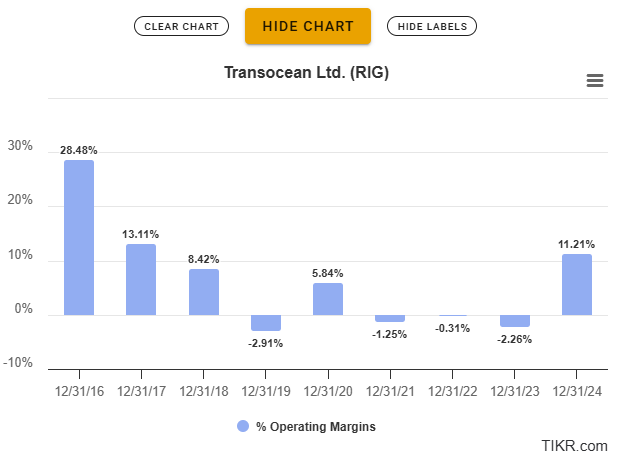

Or even worse, an offshore drilling company like Transocean:

I’m not saying you can’t make money in companies like Transocean, Exxon and AMR. Some very savvy people who I respect have large positions in these companies. But what I can tell you for sure is that I am unwilling to put large amounts of money into companies whose cyclicality is around a flat line, rather than a line that goes straight up and to the right.

Given their current valuations it seems extremely likely that both groups will beat the market moving forward, and given their cash-gushing shareholder friendly nature, the downside seems limited after the recent pullback. All companies in each group are down approximately 30% from recent highs.

Agree with finding value in homebuilders and semicap right now — seems good value, high cash generation, cyclical tailwinds

Do you expect home builders/semicap to outperform the QQQ over the next 5-10 years?

Awesome read, I love your stuff Ben!