Long term construction costs should start falling…

My latest obsession is the US construction industry, which started out focused on housing. Generally speaking the cheaper something is per pound the less likely it is to be imported and the more likely it is to be locally sourced. This is because the cost of transport relative to the cost of the thing is too high to make moving it around economically viable. Consider - you can fit many millions of dollars worth of computer chips inside a shipping container (or a plane for that matter). Relative to the cost of the chip the shipping cost is a rounding error. On the opposite end of the spectrum consider something like wood or asphalt - the cost to ship a container from China of either would be more than you would pay for the raw material - at least doubling the cost. Generally speaking, I am not interested in changing the world. I want to figure out how it works and then take advantage of that. Thus far - my observation of Trump’s second term is that he is doing exactly what he set out to do, and the signs lead me to believe that he will succeed in accomplishing his goal - which is to drive down interest rates. Consider the following

Executives at companies like Lennar, DR Horton and Owens Corning say their exposure to tariffs is minimal - and what exposure they do have primarily comes from Canada and/or Mexico.

10% realized construction cost increase is therefore unlikely and very conservative. Still - the little exercise above illustrates the greater impact rates have on total costs than the cost to build itself.

We can also do an example with housing affordability.

Part of what makes it expensive to build things in the US is red tape. I’ve seen estimates that the total cost of a house would be 10-50% lower (depending on the city) if zoning laws were eliminated.

I’m a big believer in the power of businesses in the United States to influence government. I frequently point out that the US is the ONLY country in the world where business has more power than government (and it isn’t even close). In the US - companies essentially draft their own regulations. I contend that one of the unexpected benefits of on-shoring manufacturing will be that companies lobby to cut up more red tape. IF companies have the option of building manufacturing capacity overseas then there is not much reason to focus lobbying efforts on removing red tape in the US. IF they are forced to build here THEN they will be incentivized to spend more time and money lobbying politicians to make it easier to build in the US.

There will of course also be scale economies. All else equal - more building will lead to cheaper building costs. This won’t be true in the short run (it will probably be the opposite) - but longer term it will be after capacity has ramped.

The point of the tariffs is to be nasty and chaotic

Trump’s tariffs are being criticized not just for their size - but also their implementation. Why wouldn’t Trump - if his goal is to raise money from tariffs and/or on-shore manufacturing → implement them over a period of years - for example if he wants a 20% tariff on European imports why doesn’t he start them at 5% in 2025 and build up to 20% over the next four years? Surely that would make it easier for businesses to plan and adjust?

Here’s why. It can easily take two years to permit a new factory, and another two years to build it. By the time any business expects to have a new factory up and running Trump will already be out of office.

The same timeline holds true even if massive tariffs go into place tomorrow. That still won’t speed up the construction timeline. So what’s the point?

I think the objective here is to make it obvious to business leaders that the ONLY way to secure long-term, tariff free access to the US market is to build locally. Trump wants to make it obvious that just one president can cause a world of hurt. He wants business leaders not only to fear what he can do to them over the next four years - but what any future populist president could do thereafter. Particularly as automation takes off - there will be increased (I believe) populist support for forcing on-shoring of manufacturing - from both sides of the aisle.

If businesses are not just afraid of Trump, but afraid of pain that might be caused by a populist republican OR democrat president in the future - they might decide that the risk/reward ebbs in favor of just biting the bullet and building local manufacturing capacity.

From this perspective, the nastier and more chaotic the implementation of tariffs the better. You also get the added benefit of a sudden hit to demand from the uncertainty and price increases. Ice water is being poured onto the economy. All else equal this will depress economic growth and cause interest rates to fall.

According to the Bureau of Labor Statistics - housing accounts for 32.9% of the average American’s annual expenses. What’s more, this 32.9% is a non-discretionary spending item. People have to pay for housing no matter what. Therefore it is a more frightening item to have always going up in cost. Psychologically speaking people will feel good if housing costs come down even if their discretionary purchases become more expensive.

A simple thought experiment

Let’s assume that automation is going to begin replacing both white and blue collar jobs en-masse over the next 10 years (absolutely my base case expectation). Humanoid robots are coming. Machines will be getting smarter. John Deere has tractors that drive themselves and plow fields and plant seeds without a human already. Caterpillar already has giant tractors that move dirt autonomously, and which can be remotely controlled if human intervention is needed. IF this is the future you envision then one thing is obvious - jobs will become scarcer.

Does it not therefore make sense to try and “import” as many jobs as you possibly can as quickly as you possibly can?

Most people mistakenly believe that China exports so much stuff because it has lower labor costs. While this was the primary driver for decades it is no longer the case. It’s biggest advantages today are government subsidies and policies in favor of making things, and their extremely well-developed local supply chain.

When you look at the miracle of Big Tech over the past twenty years it becomes obvious that numerous lollapalooza effects were in play. Coined by Charlie Munger, lollapalooza effects refer to the phenomenon where multiple biases or forces combine to produce an overwhelmingly powerful outcome, far stronger than any of the individual effects alone.

Autonomous machines, humanoid robots, etc - have the chance to create wild lollapalooza effects in the physical world. What we need is a catalyst to make it happen.

A frequent criticism of the idea of “bringing manufacturing jobs home” is that “Americans won’t want to sit at a table sewing shirts and underwear”. We will be importing jobs that no one wants. This is a silly criticism though. While it may be true that in Vietnam it takes 100 people to sew 10,000 shirts per day. When those jobs are imported to the US we’ll probably create more like 5 jobs. 1 person to manage the machines, 1 person to handle sales, 1 person to handle the back-office, etc. So we will not import an equivalent number of jobs, but the jobs we do import will be better jobs. My friend on X pointed out that this is something Elon said at a recent all hands meeting

In a world where humanoids are doing the work - humans all get promoted to manager.

To summarize, tariffs are a consumption tax whose longer term impact should be deflationary on actual living expenses via the rate-lowering mechanism. By virtue of making non-discretionary costs go down they also give people more optionality in their spending. They will act as a catalyst to re-shore manufacturing. The administration sees the chaos and nastiness as a virtue rather than a problem.

My construction basket

Now I want to briefly go through some info about the top holding of my construction basket - Owens Corning. All else equal - these companies should benefit disproportionately from lower rates.

As of the close on Friday this is the current allocation

Owens Corning

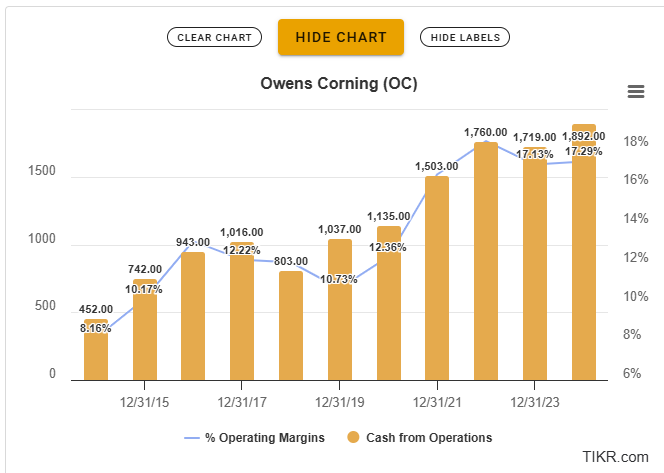

OC has some gorgeous financial trends in place

Operating margins (right axis) are heading up and cash from operations (left axis) are mooning. The outlook they gave during their prior quarter conference call is not particularly bullish but not depressed either.

Tariff exposure is minimal, and that which they do have is confined to Canada and Mexico. Anthony Pettinari at Citigroup Inc. asked the following question on last quarter’s earnings call:

“I was wondering if you could walk through maybe in a little bit more detail potential tariff impacts and the mitigation strategies that you referenced. And if there's any way to kind of quantify either percentage of COGS, percentage of sales.”

And this was their response:

When we look at tariff exposure, as Brian shared in his comments, we are mostly local for local. We produce with significantly local cost of goods sold for local customers. When we look then at what our tariff exposure could be, if we look at all of the discussed tariffs, so China, steel and aluminum as well as Canada and Mexico, to scope that, you're looking at 5% or less of our total cost for the enterprise.

Consensus earnings estimates for 2025 are almost $15 per share of earnings, which would imply a PE of 9.

Free cash flow yield is forecasted to be north of 11%

My view is that earnings and cash flow will end up being worse than this simply because it’s hard to envision the market being this bearish and wrong. The lowest estimate on the street right now is for earnings of $13.37 this year and $14.32 next. Here’s how I think about it.

Even if earnings go down 50% this year due to an economic apocalypse, the price of Owens Corning is still attractive. Sure it will get wrecked if that’s what happens - but what I am very confident in is a long-term return to new highs of earnings. I really can’t picture a scenario where margins become permanently impaired or earnings collapse and don’t return to new highs for many years into the future. Historically OC has traded with a PE of around 11.

In bull cycles that PE goes up to 15+. Let’s say hypothetically speaking earnings go to zero for the next three years, and then go back to make a new all time high in 2028 - at which point the PE goes to 15. These seem like extremely conservative figures. This would result in earning a compounded return of 14%. 15PE on $15 of EPS = $225 stock in 4 years = 14% return per year from the $134 it’s at today. Alternatively, if the bull cycle happens more quickly and analyst estimates for 2027 are correct, we get the following: $18 EPS X 15PE = $270 stock which equates to a 26% annualized return from here.

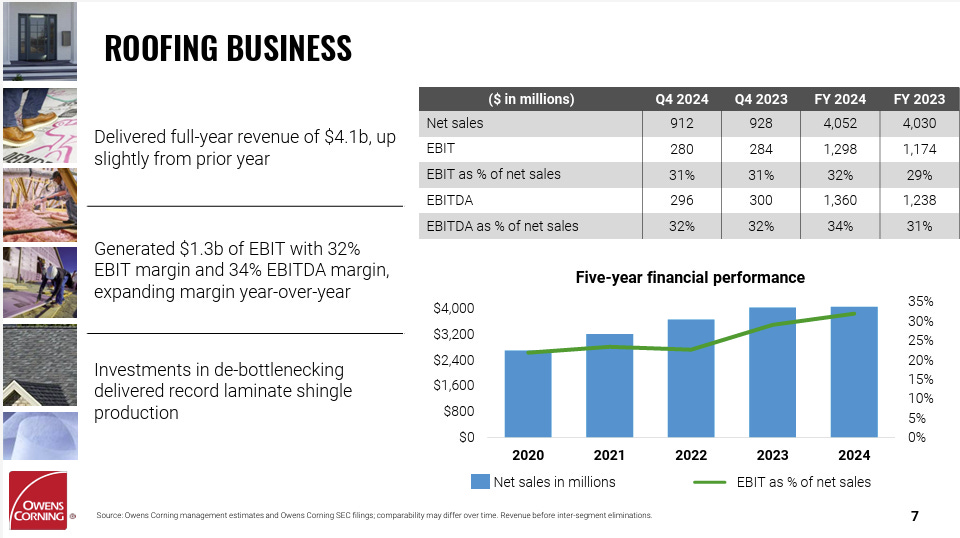

Another thing I like about Owens Corning is their roofing business

It’s pretty wild that they’re able to crank out 30% EBIT margins. Over 60% of their earnings come from roofing. Roofing is a good business. People have to replace their roofs sooner or later. What’s more? A shocking 26% of roofing projects (according to one estimate I saw) are due to natural disasters. These are paid for by insurance companies meaning they’re less tied to the cyclicality of the construction market and interest rates. According to this article, convective storms (which include hail and wind damage) resulted in $29 billion in roofing claims in 2022, and that figure increased to $57 billion in 2023. 2024 was another horrible year for hurricanes so it was probably just as nasty.