I’ve been thinking about how to use 01Core a little bit more frequently, while simultaneously not wanting to bother people who have subscribed for more in depth content. Long-form content takes up more time than I have to invest if I am going to publish on any regular sort of cadence.

So - I’ve added a new section to the page called XBytes. I am regularly bookmarking things on Twitter (now called X) that I find interesting. In this section I intend to just share the things that I have found over the prior week, along with brief commentary.

I will know whether the experiment is successful based on how many people subscribe/unsubscribe as a result. If you don’t like the new format and feel it’s spammy please let me know ASAP before I lose too many followers!

Now on with the first post…

Google is dying. Also, Google does 5 trillion searches annually?

Hat tip to @SupBagholder for the scoop - one of my favorite follows on X.

The death of Google has been greatly exaggerated. I’ll admit that I have probably dropped my own usage of Google Search by ~95% (seriously). In its place I use ChatGPT, Claude, and now Grok. However - everyone on X / Substack needs to remember that we are the few. Most people don’t know what an LLM is and have never tried ChatGPT (those are the facts). While ChatGPT now has hundreds of millions of users, Google has 7 products with 2 billion+ users:

Search

Android

Chrome

Gmail

YouTube

Play Store

Maps

What’s more, as I have described in countless posts on X and on 01Core - the killer LLM product is one that is connected directly to the operating system. One that can share screens, write emails, change settings, etc. ONLY the companies that own operating systems can deliver this.

Apple kneecapped Facebook after it realized that Facebook influenced more than 50% of app store downloads. Its fear of Facebook’s dominance of its own app store is what led it to create the “privacy” marketing campaign. As it turned out this ended up being a good thing for Facebook - but it also gave Apple what they wanted - which was dominant influence over which apps people download.

Today, Google is seeing more searches and more time spent searching because of LLMs. This means even if ChatGPT is taking share - the pie is growing fast enough to compensate. Search was up 13% YoY in the most recent quarter. Meanwhile, this is what Google’s EPS growth looks like:

Not exactly a portrait of a dying company is it?

The real question is whether ChatGPT might end up in a position like Facebook did in the early 2020s where it is having more influence over how people discover information than Google even on an Android device…

It’s possible, but both Apple and Google are in a position to “kneecap” ChatGPT just like Apple initially did to Meta. How?

They’ll release an LLM that is connected to the OS, and if need be - block ChatGPT or other LLMs from directly accessing apps on “privacy” grounds or some such theory. Would I start using Google as my go-to LLM if it were connected to everything on my phone? Obviously - so would everyone else.

What’s more? You might be shocked to hear that Google only gets 55% of revenue from Search. Cloud is the fastest growing segment, and YouTube is IMHO the most under monetized asset on Earth only after Android…

Google also has the lowest cost of delivering cloud-based AI (compared to Amazon and Microsoft).

Google trading for a multiple 15-20% lower than the S&P 500? Ridiculous.

The homebuilder / construction complex

This always has been and always will be a tech-focused newsletter. I’m pathologically optimistic about the future of technology so it’s naturally where I spend most of my time. Still, I may veer off topic from time to time. One of my favorite stock screens is to look at companies who have grown earnings at a higher clip over the past 5/10 years than their forward PE multiple. For example, a company that has grown earnings at 20%+ over the past five years, but which trades for a forward PE < 20. Or, a company that has grown earnings faster than 10% over the past 10 years, but trades for a forward PE < 10. Interestingly, there are ONLY TWO groups of companies who regularly appear on this list. There are of course other companies on it - but only two groups of businesses have almost every single constituent in the group appear. Those two groups are semiconductor capital equipment companies (Lam Research, Applied Materials, KLA Corp) and the construction complex (homebuilders like Pulte and DR Horton, and suppliers like Owens Corning and Carlisle).

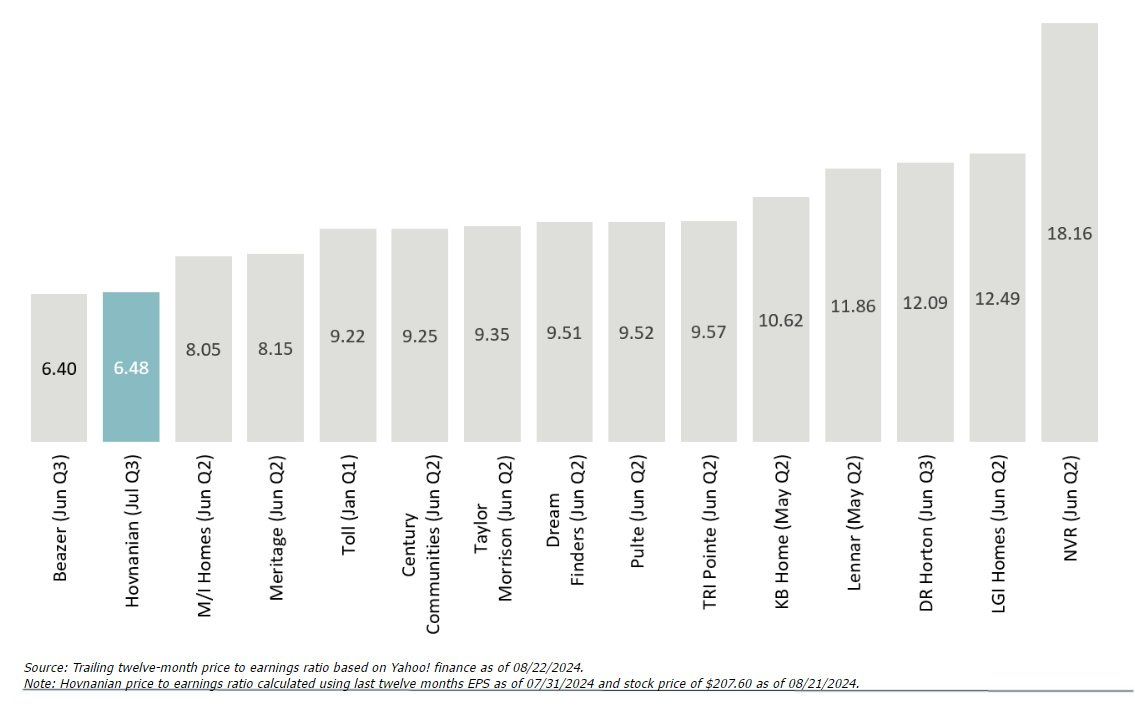

See below the multiples of the homebuilders back in August of last year - BEFORE the recent 20-30% correction:

What’s more - the companies in this complex have disgusting historical financials. Here’s Carlisle companies actual / forward estimates and P&L over the past 8 years:

Note below that gross profit has almost doubled, meanwhile EPS has increased from $3.53 to $18, with estimates around $23 for next year. Also note the share repurchases:

What drives semiconductor capital equipment makers and the homebuilder complex to be the ONLY TWO groups of companies that have this weird situation where trailing EPS growth is > forward multiples? I have a theory…

They’re both extremely cyclical and they both have extremely powerful tailwinds.

Semicap tailwinds are obvious - semiconductors are the underling magic that drives/benefits most from the exponential growth of technology.

The homebuilder complex has a few tailwinds:

Consolidation

Difficulty of acquiring good lots at scale (smaller builders can’t compete)

Under supply of housing stock

Higher costs (contractors and raw material) wreck smaller builders

Blue-state to Red-state migration

Less rate sensitivity b/c can buy-down rates (again, small guys can’t)

Combine the above with homebuilders’ new asset light business model (optioning vs. owning lots) - and the complex as a basket looks more like a group of highly cyclical manufacturing companies than it does a bunch of real-estate speculators. Suppliers like Owens Corning and Carlisle have - literally - decades ahead of them to consolidate the market. Check out the stock charts of Waste Management and Republic Services if you want to see how beneficial it is to have an infinite amount of opportunities to roll up a market by purchasing at one EBITDA multiple, then using your scale to make the effective acquisition multiple 30%+ less…

We’re sitting on 7% mortgage rates and homebuilder margins are doing just fine. There’s always the possibility that the bottom falls out of the market - this might happen because rates drop (ironically) and a flood of existing homes comes to the market - or it might happen because we actually get a recession and stock market crash which impacts housing via the net-worth effect. However, what is obvious is that long-term earnings will go on to make new highs, and in the mean time you have a basket of companies that are more shareholder friendly than any others - by far - who gush cash and will use it to re-purchase shares throughout the down-cycle.

AI Cracks superbug problem in two days that took scientists years - an example of Acceleration

Another fun guy to follow on X is @Dr_Singularity. Here’s one of the more interesting use cases of AI I’ve run across recently

From the article:

“A complex problem that took microbiologists a decade to get to the bottom of has been solved in just two days by a new artificial intelligence (AI) tool.

Professor José R Penadés and his team at Imperial College London had spent years working out and proving why some superbugs are immune to antibiotics.

He gave "co-scientist" - a tool made by Google - a short prompt asking it about the core problem he had been investigating and it reached the same conclusion in 48 hours.

He told the BBC of his shock when he found what it had done, given his research was not published so could not have been found by the AI system in the public domain.

"I was shopping with somebody, I said, 'please leave me alone for an hour, I need to digest this thing,'" he told the Today programme, on BBC Radio Four.

"I wrote an email to Google to say, 'you have access to my computer, is that right?'", he added.

The tech giant confirmed it had not.

The full decade spent by the scientists also includes the time it took to prove the research, which itself was multiple years.

But they say, had they had the hypothesis at the start of the project, it would have saved years of work.”

This is an example of the type of acceleration we’re about to start seeing everywhere. I explained what this will feel like in a post on X (apologies if it’s a repeat for you):

If you think it is going to take humanity 50 years to figure something out (a cure for cancer, AGI, etc) - we might be just 11 years away. Before I walk through the math here are a few points worth noting:

1. Some types of compute efficiency (alternatively: the cost of intelligence) are improving by 50%+ per year.

2. Efficiency in analyzing biotech lab samples has improved by around 40% per year over the past 20 years (we can now test millions of samples with the same amount of human resources that were once capable of handling thousands).

3. However many people you think are working on a problem - the number is likely to be at least 10X higher. Why? Because most people working on compute efficiency, AI, robotics, etc are at least tangentially working on that problem. For example, no one would have thought about Nvidia as a "natural language processing company" a few years ago, but we now know that their GPUs are what unlocked ChatGPT. A similar argument will soon be made regarding their Chips' impact on biotech (as Jensen so regularly reminds us).

This is the beauty of general purpose technologies and the MEGA trend of everything turning into an engineering problem.

Now for the math. Let's be a tad more conservative than the above numbers imply might be possible and assume that we're accelerating the rate at which we're solving a problem by 30% per year. Put differently:

From 2024 to 2025 we make one year worth of progress.

From 2025 to 2026 we make 1.3 years worth of progress (30% more).

From 2026 to 2027 we make 1.69 years worth of progress (30% more than from 2025 to 2026).

The numbers blow up pretty quickly:

By year 7 we will have made more than 17 years worth of progress, and by year 10 we will make 10 years worth of progress in a single year, and will have made 42+ years worth of cumulative progress.

Most people need to dramatically shrink the timelines over which they expect the seemingly impossible to turn into the imminently probable.

Please remember, if you like this shorter form content and style please let me know - if you don’t like it it’s even more important to let me know!