A deep dive on Google

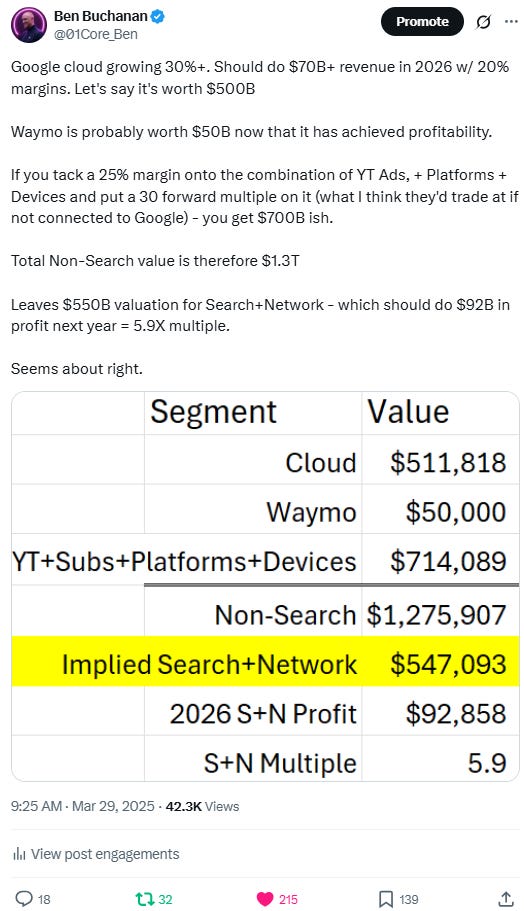

It is quite in vogue these days to predict the death of Google. I even saw one rando on X comparing it to Kodak. I went through some napkin math on X which went viral

139 bookmarks? Lfg baby!

I also drew some (fair) criticism

Waymo IS probably worth zero if Tesla cracks FSD with its existing suite of cameras. That said, I haven’t seen anything which leads me to believe they will (I say this as someone who has used FSD extensively). My current guess is that by the time Tesla achieves full and scalable autonomy it will need to have a lot more cameras and/or other sensors. The problem is if your autonomy only works in good weather people could get trapped by a sudden burst of rain forcing the cars to immediately pull over. I just don’t see how this gets solved without adding redundancy (which very well might mean just adding more cameras instead of LiDAR).

Gambrinus points out any analysis conducted this way will leave the last bit undervalued. He’s not wrong, though I don’t think my valuation estimates for the different businesses are far off (more on that below). Valuations today in private markets are insane, but even public market comps are high and to me indicate that a sum of the parts (SOTP) method ends up with Google looking cheap no matter how you dice it.

I’ll also say that while SOTP valuations are fun, they are frequently nothing more than mental masturbation. Sure there are people out there who think “it’s healthy”, but is it really helping you achieve any tangible goals? The purpose of any valuation is singular: help the investor make good decisions. Insofar as a SOTP makes that happen I think they add value. When it comes to Google I actually do think the SOTP is useful. But not because I believe it’s the best way to come up with a fair value for the equity (Sergey and Larry control the business and have zero interest in spinning off anything - they would only do so if forced). I think it’s useful mostly because it helps paint a picture of how diversified and strong Google really is.

In this post I’m going to talk about how I view Google.

What are we starting with?

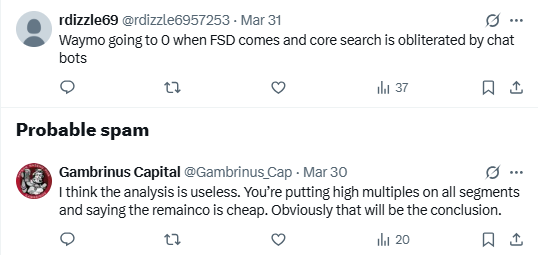

I think this is how most people view Google today:

It is a formidable company but one that is being attacked on all sides, including by the company destined to become the next Big Tech Consumer business - OpenAI - who is also destined to render Search a relic of the past.

Another key part of this image is the fact that all of Google’s resources are fixed (a pile of gold coins). Rather than being “renewable resources” with lots of optionality, they are perceived as businesses whose best hope for generating profit is to defend their existing turf - which is a fixed size. Google is perceived as a company who will respond to disruption by spending all of their effort guarding their existing treasure (very similar to how Microsoft was perceived pre-Satya).

Quick aside - note how the OpenAI dragon is actually focused on Search? Idk if the AI was smart enough to do that but damn…anyway

I think a more accurate view of Google today is the following:

Notice the difference? There is no other dragon… The threats are soldiers - manageable.

Or better yet, this - the threats are so small as not to be noticeable compared to the opportunity to invest its profits.

I believe Google has a collection of assets that are:

Extremely profitable, and whose true profit generating capacity is not even understood by Google

Still in growing markets, with TAMs that are dramatically under estimated

NOT under attack by existential threats

Unmatched in terms of future optionality

In the image the dragon is using profits from its assets to invest in a new business venture - it is focusing its time on leveraging its resources to become even bigger! Not just to protect an existing asset base that is under threat…

I think there are two historical analogies that are apropos today.

Microsoft missing all the waves; Meta getting pounded by TikTok

Here’s a chart of Microsoft stock from 2006 to 2014

Microsoft traded sideways while it’s multiple compressed for a variety of reasons:

Stagnant Revenue Growth Perception: While Microsoft’s earnings from Windows and Office remained robust, revenue growth slowed compared to the hyper-growth of Apple and later Google. The PC market matured, and shipments declined as tablets and smartphones took over. Investors saw little evidence of Microsoft replacing this with new revenue streams, leading to a lower growth premium.

Missed Mobile Revolution: The iPhone’s success highlighted Microsoft’s inability to lead in mobile, a market that exploded in the late 2000s and early 2010s. Windows Phone’s failure to gain meaningful share (peaking at just over 3% globally) meant Microsoft wasn’t participating in the fastest-growing segment of tech, dampening enthusiasm for its stock.

Competitive Pressure: Beyond Apple, competitors like Amazon (with AWS starting in 2006) and Google (with Android and search dominance) were capturing the future—cloud computing and mobile advertising—while Microsoft lagged. Its Azure cloud platform didn’t launch until 2010 and took years to scale, leaving it playing catch-up.

Market Sentiment and Risk Aversion: Post-2008 financial crisis, investors favored companies with clear growth narratives. Apple’s iPhone-driven ascent made it a darling, while Microsoft’s steady but unglamorous profits from enterprise software and legacy products didn’t inspire the same excitement. Its P/E, which had been in the 20s in the early 2000s, fell into the low teens by 2012, reflecting a "value stock" rather than "growth stock" status.

Leadership Doubts: Ballmer’s tenure became a lightning rod for criticism. His dismissal of the iPhone, combined with costly missteps like the $8.5 billion Skype acquisition in 2011 (seen as overpriced at the time), fueled a narrative of poor capital allocation and lack of vision. This eroded confidence in Microsoft’s ability to deliver outsized returns, compressing its multiple further.

From 2007 to 2012, Microsoft’s stock hovered between roughly $20 and $30, while its earnings per share grew modestly (from about $1.42 in 2007 to $2.00 in 2012). Its P/E dropped from around 20 to below 15. The S&P 500, despite the 2008 crash, began recovering by 2009, but Microsoft lagged, underscoring its “specific challenges”. By 2012, its market cap was overtaken not just by Apple but also briefly by others, like ExxonMobil, highlighting its fall from grace.

The narrative shifted slightly toward the end of this period as Microsoft showed early signs of adapting—Windows 8 and Surface launched in 2012, and Azure gained traction—but these were seen as too little, too late. It wasn’t until Satya Nadella took over in 2014, refocusing the company on cloud and subscriptions, that the stock broke out of its funk.

With the benefit of hindsight it seems obvious that Microsoft never should have traded at a low teens multiple. With hindsight it seems obvious that owning the operating system for PCs was an asset whose TAM would grow even if unit sales of devices stopped growing. With hindsight, it seems obvious that Microsoft was well-positioned to leverage its customer base to take share in the next transformative technology paradigm.

The Meta TikTok battle is also apropos. TikTok IS a competitor - that is obvious. Were it to disappear tomorrow Meta would gain lots of advertising dollars. One thing substituting for another is the literal definition of competition. But…TikTok essentially created a new addressable market that Meta wasn’t going after. That new market (short form video) ended up being huge. Meta and TikTok are both growing simultaneously at the expense of other ways people were spending free time (e.g. mobile gaming). Meta was able to take advantage of short-form because of its distribution. Having 3.5B daily customers gives you some breathing room to respond to new threats. For perspective, Meta was sent through a 70% drawdown b/c TikTok was growing from 500m to 1B+ users. Despite that wild user growth Meta’s users never dropped - time spent on their family of apps never dropped - and their revenues have mooned over the period (along with margins). We had a situation that looks like this:

Yes - market share dropped - but revenues and profits increased because they were still able to lock down a piece of a larger market.

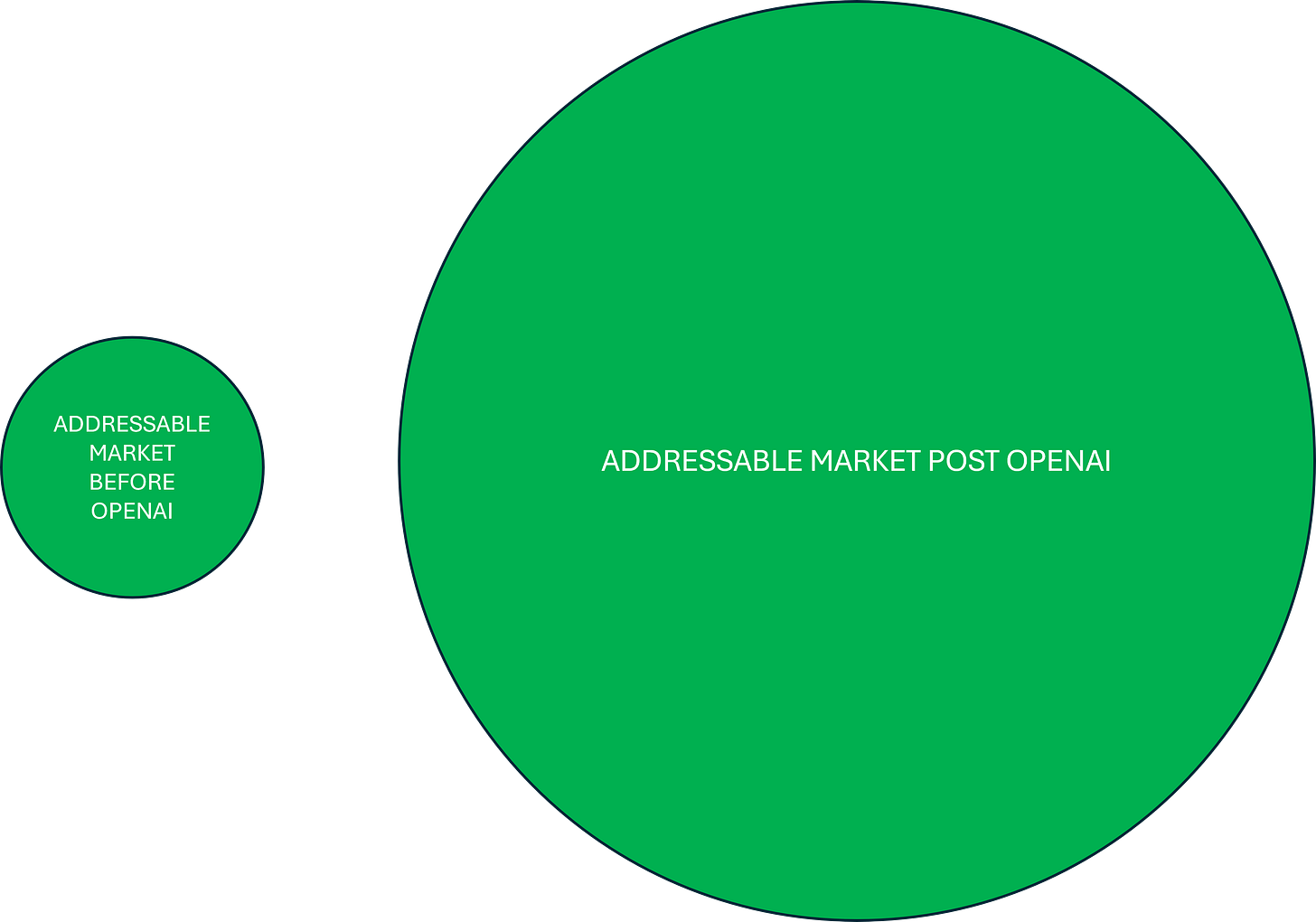

Take a moment to think about where we would be if OpenAI hadn’t come along. I explained in a post in early 2023 why Google had never launched a product similar to ChatGPT. They already had the technology - but they were too afraid to release something that could “hallucinate” “lie” “be racist” etc…And when you have been CAGRing EPS 20%+ for 20 years why bother taking big risks?

OpenAI actually made Google - imo - a MORE VALUABLE COMPANY. Why? The value of a company is equal to the present value of its expected future cash flows. OpenAI released the kraken. It gave Google the cover to compete and enter new markets without the fear of becoming a political lightning rod and bringing down the gavel of government on its head. It accelerated the arrival of what will end up being massive new sources of cash flow growth. I think the before and after analogy for Google and OpenAI is more along the lines of this.

What’s more, the existence of OpenAI is probably a good thing for Google moving forward as well. Why? OpenAI and other LLMs will be forced to take risks that Google doesn’t want to take (for example, enabling higher levels of personalization in LLM response/behavior, more flexibility over imagegen, etc). If not for companies like OpenAI Google would not take these risks on its own. However, if other companies take the risk of public perception issues due to new features first, then Google is less worried about taking heat by simply releasing something someone else has already created.

At the end of the day they will always be able to rely on distribution to catch up, so they can strategically sit “behind the front line” - but not too far.

The Search Elephant

I’ll be the first to admit that LLMs have replaced Search for me almost entirely. My rough estimate is that I use Search 95% less than I did before LLMs came out. This is obviously a bad thing for Google. For decades “Google” has been a verb synonymous with the activity of “finding information” or “learning”. I remember many years ago asking my grandmother to quiz me about random historical facts - which I would then look up on Google and provide the answer for. Her mind was blown. Google was the company associated with making information free and available to everyone.

I’ll also note that the use of Google as a “verb” is all but dead in my own life and is absolutely 100% dead among Gen Z. For younger members of society Google is not only being replaced by ChatGPT - but also by TikTok. I never tell anyone to “Google” anything anymore. It is not remotely as good of an experience for learning about the world as using ChatGPT or LLMs - even with its new embedded AI responses (though Gemini 2.5 is absolutely top notch).

Interestingly, I believe TikTok, Amazon, and Meta are all bigger competitors to Search (and bigger “threats”) than OpenAI. Why? Because the things people search on Amazon (products), TikTok (the place GenZ goes to research restaurants or look for travel tips), and Meta (similar to TikTok but also now has What’sApp being used to communicate with businesses about their products, etc) - are the things that would generate Google ad revenue.

Ironically, all of the real threats to Google’s search REVENUE are the ones no one talks about. The part of Search that is most under threat from OpenAI (e.g. market research) never generated Google money anyway.

The real threat to search medium→long term is Agentic AI and new operating systems (more on that below). Rather than a human searching for a pair of sneakers to buy - they just ask the AI to do it and show them the top 3 choices.

Today you use ChatGPT to plan a vacation to Italy but then once you’re done you go right to Google to purchase the tickets, book the hotels, etc. Once ChatGPT is plugged into the internet and can manage the process of filtering through hotel options, rental car options, etc - it would become a serious threat.

But this use-case is something Google (and Apple) are in a far better position to provide…

The everything app

At the end of the day people will use as few apps as they can to accomplish their objectives. This is essentially a law of physics. The long-term end state of Agentic AI (what LLMs will evolve into) is EXTREMELY OBVIOUS.

It will be a personalized Agent - with an Avatar you select just like picking out a character’s appearance in a video game - with a personality that adjusts to yours over time (adjusts how flirty it is, what political views it has, etc). It will be connected to the operating system of your phone - and your interaction with apps will probably drop 50% because you will just ask the AI to do things. It will handle booking an Uber. It will handle ordering AND purchasing groceries and having them delivered autonomously. It will respond to work emails on your behalf. It will share screens with you and be tech support, copy-writing help, strategy whiteboarding partner, and so on…It will be intimately familiar with your personal and professional life…

It is absolutely hysterical to me - and I mean it literally makes me laugh out loud - every time I hear some idiot proclaim that they don’t want to give the AI their “personal information”.

Meanwhile they’re uploading pictures of what they had for lunch along with a location timestamp to Instagram just after posting a picture of their baby’s cute new outfit. Did I mention that the phone carriers literally know where they and their family are 24/7?

haahhahahahahhahhaahhahahahahahhahahaahaahahhahaha

The value people will derive from having AI be intimately familiar with their lives is so enormous we all will do it. We’ll share our darkest secrets with it - our biometric data with it - literally everything… And it will use that information to transform not only our health but also our happiness (wrote a little about that here).

The point of all this is that ONLY a company who owns an operating system can deliver this killer experience. You need control over the OS to…

Optimize latency

Offer “agency” to the AI securely

Force other apps to give the AI access

Make the entire experience seamless

Apple used “privacy” to cut off Meta’s access to app purchase data. It’s an absurd argument but it worked because our politicians and regulators are morons.

Given that precedent, how much easier will it be for Apple and Google to argue that they “can’t” provide other companies with access to the operating system for security reasons?

Piece of cake. “No Mr. Government, I’m sorry, giving ChatGPT access to people’s Wells Fargo account is just a step too far, there’s no way to do it securely”.

But there are other issues too.

Adobe obviously will not be thrilled about ChatGPT becoming the main way people use it. Remember - the future of graphic design is not sitting there dragging and dropping with a mouse - the future is talking to the AI, telling it what you want, and having it use the tool on your behalf.

Similarly, Bank of America will not want to let OpenAI be how people send money on Zelle (in the future, we’ll just ask our assistant to Zelle someone when we want to send money).

Effectively, Agents will become a new operating system that will operate in parallel to iOS or Android - but only Agents provided by the owner of the operating system will be capable of delivering an “everything app”. And even if someone else came along who could deliver a similar experience, Apple and Google will just shout “Security” and then knee-cap the functionality of competitors.

What’s funny is that both Sam Altman and Mark Zuckerberg AGREE WITH THIS AND SAY SO PUBLICLY ALL THE TIME! I feel like I’m screaming into the void when I point this out.

Sam’s vision is for OpenAI to offer the service that houses your memories, digital experience history, stores your logins, etc. He explicitly stated this in his recent interview with Ben Thompson. When I hear him talk it’s clear he wants to make their product a “4th component of the GUI” we use to interact with the digital world.

He is also known to be interested in (if not working on) an “AI First” device and alluded to this a few days ago in a response to a post on X

Mark Zuckerberg is trying to build an operating system for the next form factor (glasses) for interacting with the digital (or augmented) world - because he knows Apple and Google are who has the real control by owning the OS.

So again, we have a situation where people perceive OpenAI to be the biggest threat to Search - but in reality the bigger threat is actually the companies who are likely capable of competing with their operating system - not the “search application”.

To be fair - OpenAI just closed a $40B funding round and now has 500M+ users and as of yesterday was gaining users at the rate of 1 million per hour. This capital will probably be equivalent to $80B in the hands of Google or any other member of Big Tech (seriously, I think OpenAI is probably that much better at allocating capital - which is easier given their size).

Effectively, this new funding round gives OpenAI a war-chest that is on par with a Tech Giant. Combine that with 500 million+ users and you have what is obviously the most legitimate threat to Big Tech in history (outside of Big Tech being a threat to other members of Big Tech - which it is - but has never mattered because the TAMs keep growing so fast). To be clear, I’m saying OpenAI is a far bigger threat to Big Tech than TikTok ever was…

I believe we’ll find out that OpenAI is launching a smartphone device sometime late next year or during 2027. Why then? Because my view since the beginning of 2023 remains unchanged that delivering Agentic AI on a phone won’t be possible until late 2027 or 2028 given design cycles. You just can’t build a new device any faster when you are working with hardware that needs a fundamental update (chips) and not just software - and no one was even trying to work on AI first hardware until after ChatGPT came out.

This is the real threat to Search long-term - but it is a longer-term threat. And it is actually MORE of a threat to Apple than it is to Google - by far - because if Apple loses a smartphone customer it loses everything. Google has far less to lose given how much more diversified their business is. And - we just might see a super interesting twist where OpenAI builds on Android and becomes a Google Cloud customer…But again - these are longer-term predictions.

Remember, Amazon and Microsoft had a go at launching a smartphone. Meta has been pouring tens of billions of dollars per year into their new OS contender. OpenAI certainly has a shot at creating a new AI-first OS, but it’s a tall ask and the incumbency advantage is enormous.

To summarize the key points here:

Search is threatened by Agentic AI - not LLMs in current form

The killer “Agentic AI” app requires ownership of an OS

Start panicking about Search dying once new OS’s come out

Let’s talk about TAM

Everyone forgets that once upon a time phones were cheap. The Razor was the expensive version all the cool kids wanted. None of them cost half what a smartphone costs today. Only business people and rich people had Blackberry’s.

Smartphones added so much additional functionality that people adjusted their expectations around what a phone should cost. In fact, they offered SO MUCH value that carriers started subsidizing the cost en-masse - with zero interest financing - using them as a loss leader to get new subscribers.

Today some number of people are paying $20/mo for ChatGPT, but most people are not. My view is that five years from now EVERYONE will be paying big money for agents OR suffering through tons of ads if they want to use them for free. Maybe the cost of Agents is subsidized through Verizon and AT&T? Idk. But one way or another the providers of Agents will get paid for the value they deliver.

I am already paying $100+ for different AI apps per month. They all could be replaced by a single AI app with agency. I’ve talked a lot about how much value is delivered by agency, including in this post from January of 2023:

1 billion new people, but no more mouths to feed. Yet another ChatGPT post.

One way to think about technology is that it is a mechanism for lowering the cost of intelligence.

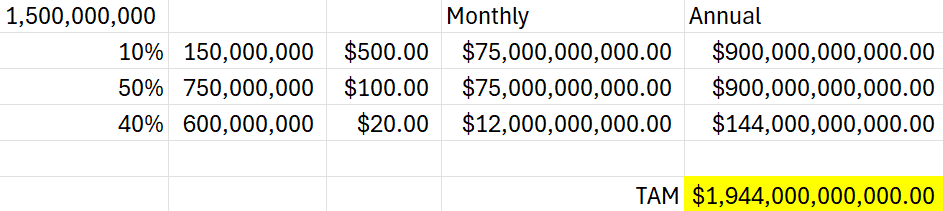

I won’t belabor the point, suffice it to say I think it’s reasonable to assume that every human in the developed world will be spending at least $20/month on Agents, with the top 10% spending $500+, and with somewhere around half spending $100+. This gives us the following

That’s $1.94Trillion of revenue opportunity to be split amongst Apple, Google, Microsoft, and whoever else can grab a slice. Microsoft and Meta probably duke it out in the small business space, with Apple and Google carving out nice chunks among their own user bases (with Apple gaining the lion’s share - should it execute well - because of it’s customer base essentially being the 15% wealthiest humans). For reference, TTM revenues for Apple, Microsoft and Google combined are around $1T.

These revenues probably start to kick-off in a meaningful way in 2028/2029. My belief is that over the next 10 years people will once again be surprised at the performance of big tech - and for the same reason that they have been surprised the last ten years - the TAM just keeps growing…

How big could the cloud get?

Funny you should ask. I wrote a post on this pre-ChatGPT in April 2022.

How big could the cloud get?

If you’ve read my other posts you know that I like to explain things through analogies. The cloud is on its way to becoming as core to life as electricity. My goal with this post is to explain why that statement isn’t an exaggeration. Below I will:

Obviously I have upped my expectations by orders of magnitude now that Agentic AI is right around the corner.

The TAM for the cloud was already heading toward $1T+ in annual revenues by 2035 before AGI. In a post-AGI world it’s impossible to estimate, but I can guarantee that no one’s estimates are bullish enough long term. Why? Because people estimate by extrapolating existing trends. The largest user of compute in a post-AGI world will not be humans - it will be computers. Until we see how much compute AI Agents use when they’re interacting with each other autonomously solving problems - we won’t have anything relevant to extrapolate insofar as predicting the TAM 10 years out.

Again - the takeaway is that “Big Cloud” (Google, Microsoft, Amazon) or what I refer to as the “Base-Layer” in prior posts - will have a TAM that keeps on surprising to the upside.

YouTube

Google’s other big business is YouTube. My estimate is that YouTube should trade at a premium to Netflix on a per-dollar of revenue basis. It is a better business model with a stronger moat and larger TAM. YouTube (YT) generates revenue from both ads and subscriptions. Google doesn’t breakout revenue for the subscriptions, but according to Google there were 125 million YT premium subscribers as of March 2025. At $10 per month this equates to $15B per year. I’m going to call it $13.2B per year because that’s the estimate ChatGPT came up with and it’s a little more conservative. Combining that with the publicly disclosed ad revenue gives total revenue for YouTube of $49B. I find it hard to imagine that YouTube is worth less than Netflix on a comparative basis - the moat seems stronger plus I think YT has more utility as a training source for new AI applications/more optionality. If we take YT revenue and divide it by Netflix revenue and then multiply by Netflix’ valuation then we get $49B/$39B = 1.27 X $400B = $506B of value for YT.

You can argue that Netflix is overvalued - that’s fine, I agree. But I also believe YT has far more optionality than Netflix and a more attractive business model with far less terminal value risk - so if Netflix is overvalued YT could still arrive at the same place with an imo well-deserved premium.

I think one of the most interesting things we’re going to learn in the next two years is what type of data is useful to train AGI - both AGI that is embodied physically and that which only exists in cyberspace. YouTube seems like it will be THE single most useful resource for this purpose - time will tell.

Okay, let’s value google SOTP style

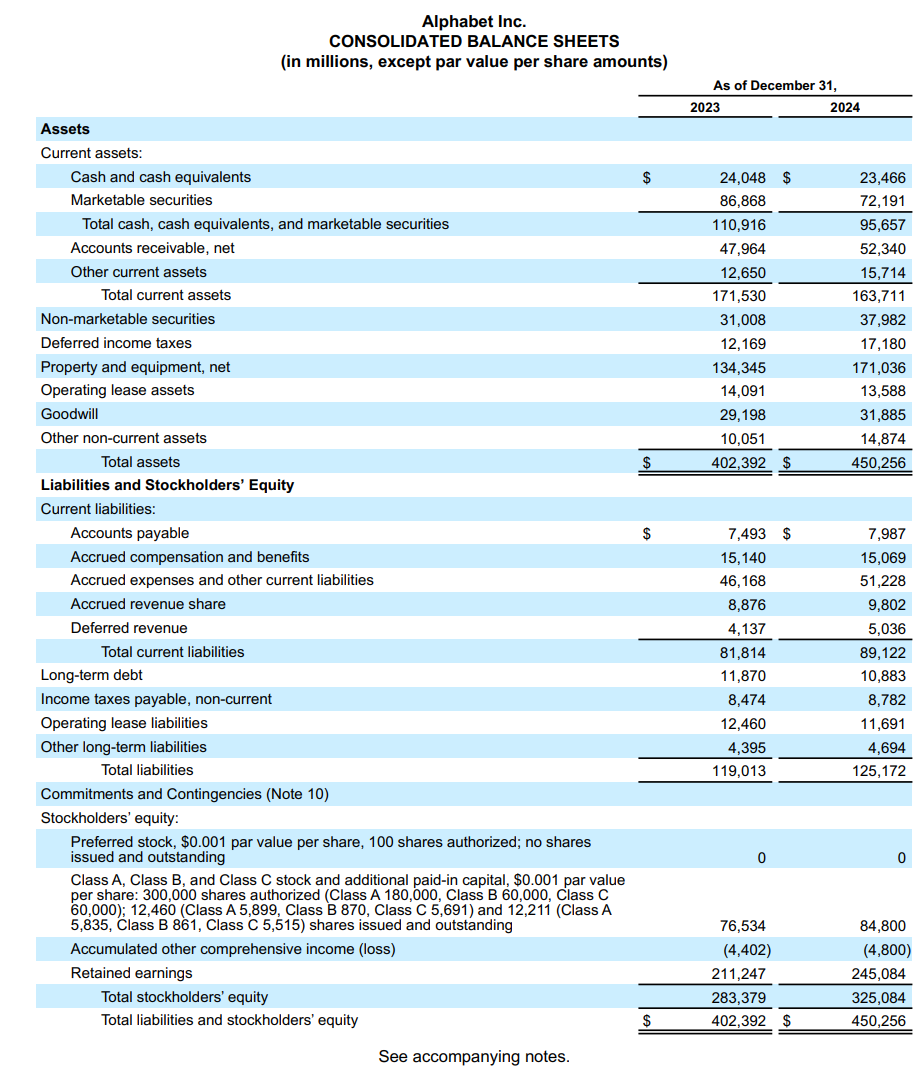

First up the balance sheet

A company like Google does not need to carry a net cash balance. Hence what we can take off the balance sheet is: Cash + Marketable Securities + Non-marketable Securities (their VC portfolio, non-control assets, etc). I’ll net out the debt - which gives us the following:

$122.75 billion - they could kick this out as a dividend to investors without impacting the business

Waymo

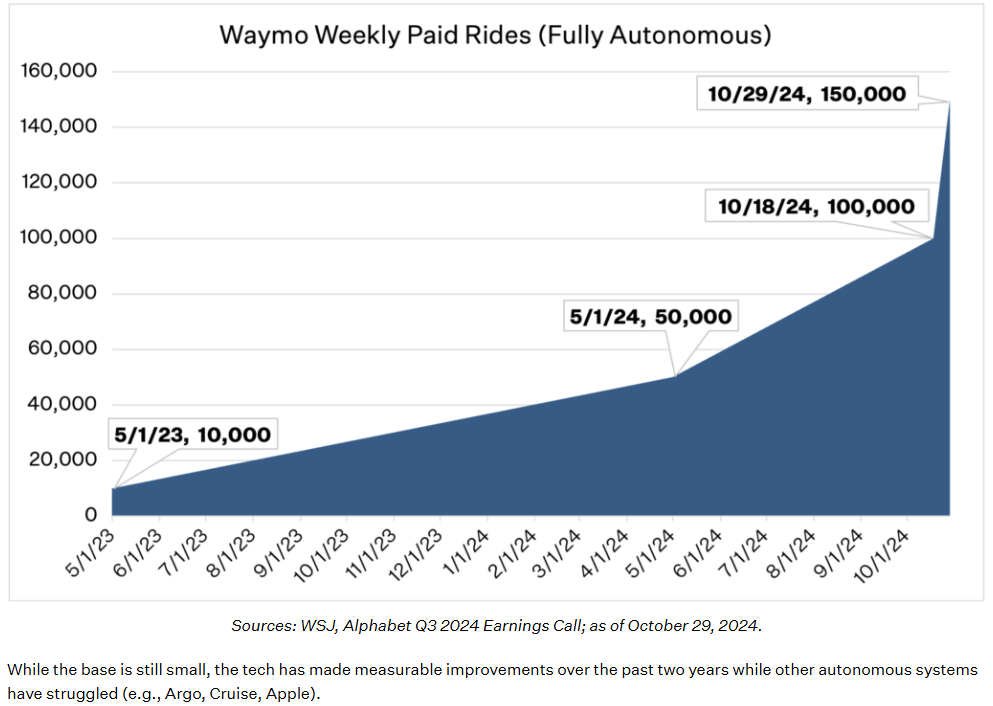

Waymo was valued at $45B post-money in a $5.6B funding round last October. It was the first funding round since $2.5B in June of 2021 and $2.3B in March of 2020. The larger amount of capital is probably because it has cracked the nut on scaling a profitable ride-hailing service and is now ready to grow exponentially.

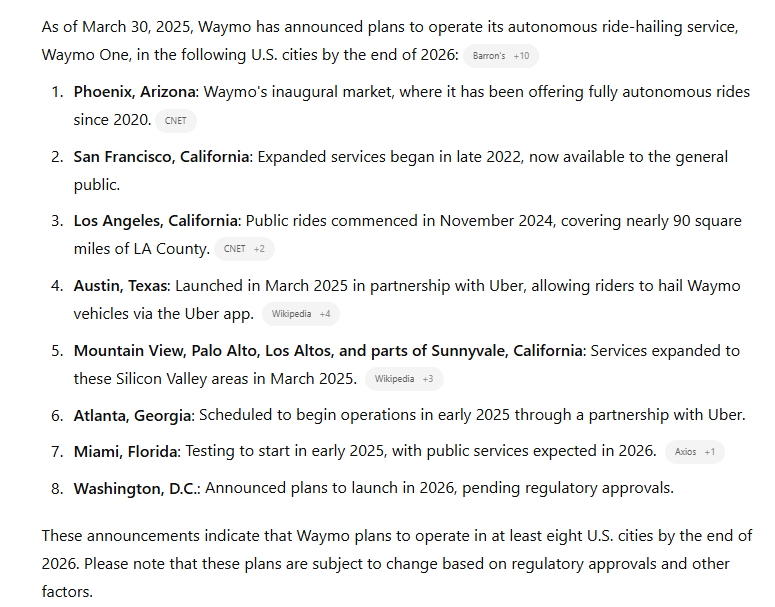

Rides per week went up 15X from May 2023 to October 2024. As of March the number of rides per week had already increased to over 200,000. Today Waymo is in Phoenix, San Francisco, and LA. By the end of 2026 it has already announced its intentions to be in the following cities

There is a fascinating and ongoing debate about the different approaches to autonomy taken by Waymo and Tesla. Relevant to coming up with a valuation for Waymo is considering the differences in potential business models. On one hand you have ride-hailing - a business model that is pretty well understood. Waymo’s ride-hailing service could operate like Uber without the share of funds needed to pay the driver, but with more expensive vehicles and back-end tech support.

The second potential business model is licensing their technology to auto OEMs who want to sell autonomous vehicles. Every month there are new rumors about car companies licensing Tesla’s technology. While I am as long-term bullish on Tesla as anyone, I do not believe their current sensor suite can accomplish autonomy. Hard rain, sun glare, and snow all cause FSD to glitch. I don’t see how you solve this problem without adding new cameras or sensors to create more redundancy. We’ll find out when their program launches in Austin. But - until Auto OEMs see Tesla’s driverless technology working at scale I don’t believe we’ll hear of any concrete plans to integrate the tech into their production lines. On the other hand Waymo has officially cracked the nut. Today GM could start retrofitting their models with Waymo and sell a vehicle that could operate with full autonomy in any of the cities where Waymo operates. I doubt any auto companies were even aware of the step-change in daily rides Waymo just experienced. But I do think that the big OEMs are now probably in active talks with Waymo about integrating their tech into production lines. My guess is we see our first signed deal by the end of this year, with at scale production scheduled for end of 2027/early 2028.

A third business model could emerge where Waymo becomes a direct Uber competitor - using their app not only for their own vehicles, but for other autonomous vehicles to plug into. For example, a new business model I expect to emerge near the end of this decade will be consumers purchasing autonomous vehicles so that they can still have total control over it, but then choosing to rent it out when it is available and not being used to earn some extra money and subsidize the cost of the vehicle. Or alternatively, they just want to have the ability to not focus on driving, or to share a single car in a family instead of needing multiple cars (pretty easy to do if the car drives itself). Even if they purchase an autonomous vehicle from GM, it will probably need to run on Waymo software.

I can only envision one scenario where Waymo is worth less than Uber by 2030 - and that is because it becomes obvious that Tesla is going to mop the floor with everyone else. Elsewise, it seems obvious that Waymo will overtake Uber in value because its business model is far superior.

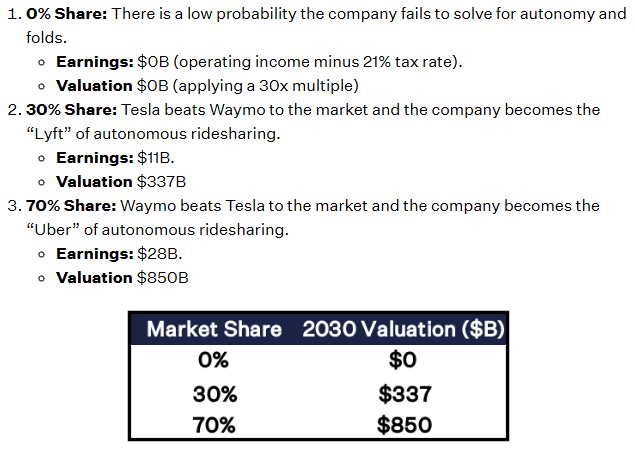

Deepwater - famous for being bullish (it’s worked out very well for them historically) believes Waymo has three potential valuations circa 2030 (Share refers to % market share of ride-hailing):

I don’t see any world where they don’t solve autonomy given they’re now doing 200k rides per week and growing quickly. If they do hit a $0 valuation it will be because of Tesla. Still, until Tesla proves its hardware is capable of autonomy, investors will not see it as a threat to Waymo. Net-net, it seems very reasonable to value Waymo at $50B - which is just $5B more than their latest funding round. I bumped it up a bit because of the recent progress.

We now have the following for our sum of the parts (SOTP):

Cash + Investments: $122.75 billion

Waymo: $50 billion X 70% ownership = $35B

Youtube we already did, which gives us:

Cash + Investments: $122.75 billion

Waymo: $35 billion

YouTube: $506 billion

Android + Hardware

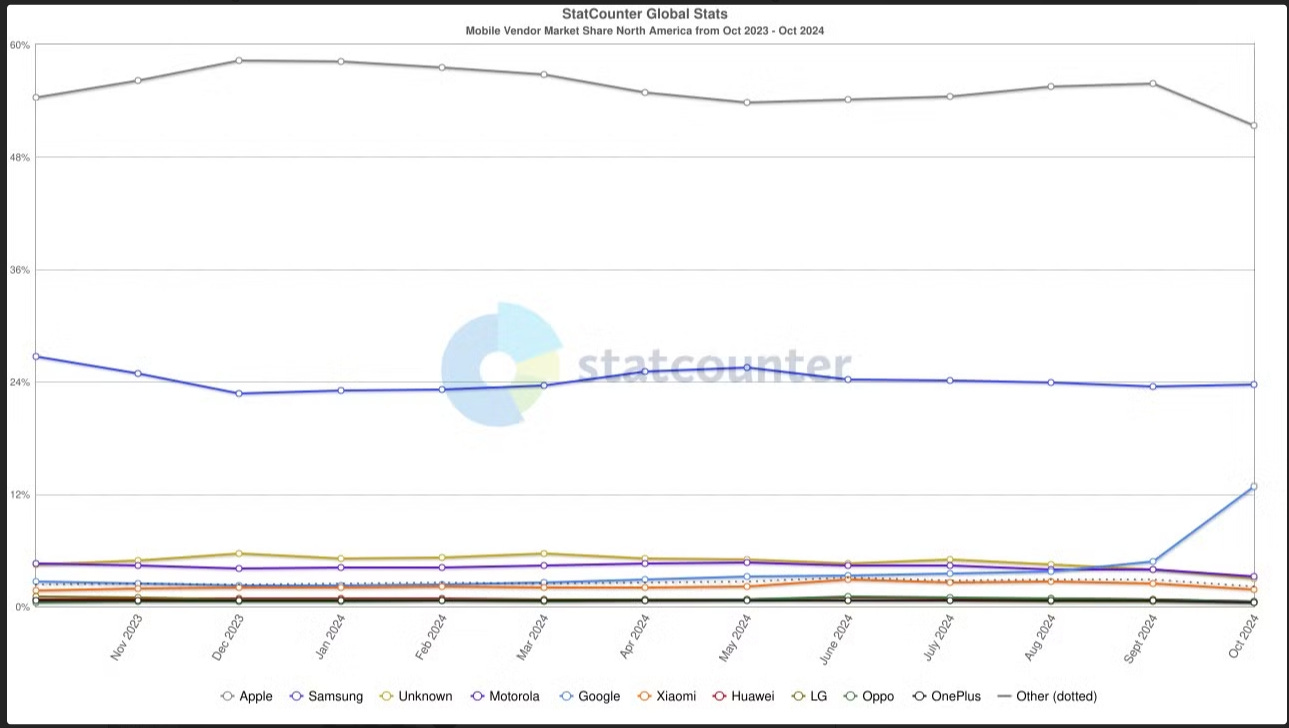

I’m going to lump other non-cloud subs into this category for ease. The big revenue items are Hardware sales and Play Store. Together with other non-cloud subs we have $26,800, with hardware probably around $12B of that and PlayStore probably around $10B (other subs/revenue hence at $4,800). According to documents from the Epic Games lawsuit against Google, the PlayStore has operating margins of ~70%. My guess is the operating margins on the other subs piece of the businesses are probably pretty good, but I’ll call them 50%. Hardware is probably not generating much if any profit. Most of the value from Android comes in the form of ecosystem control and being able to put whatever apps Google wants as defaults on the operating system. Interestingly, Pixel market share jumped at the end of last year with the new model launch:

That little blue line that jumped away from the rest of the laggards is Pixel. I think Android is the most under monetized asset on the planet. Android has 70%+ market share of mobile devices and somewhere between 3.5B and 4B active devices. Android is how Google will distribute AGI in the future. If we assume 70% margins on the PlayStore, 0% margins on devices, and 50% margins on other subs we get $9.4B in operating profit. Putting a 25 multiple on that gives us $235B. This seems very reasonable if not conservative given the optionality that comes with owning Android.

This gives us the following:

Cash + Investments: $122.75 billion

Waymo: $50 billion

YouTube: $506 billion

Android + Hardware: $235B

Cloud

Cloud includes GCP and products like Workspace. It grew 30% last year and it would have grown faster if they weren’t resource constrained. Margins are rocketing. Microsoft trades at 9X NTM revenue. Microsoft is one of the most profitable companies in the world with 35% net income margin, but it is also growing at less than half the pace of Google’s cloud business. If Cloud were valued at 9X NTM revenue we get a valuation of $503B. Alternatively if we assume 25% steady state margins and put a 30 multiple on it (seems conservative given growth rate) we come up with $420B. Let’s go with that to be conservative. Now we have the following:

Cash + Investments: $122.75 billion

Waymo: $35 billion

YouTube: $506 billion

Android + Hardware: $235B

Cloud: $420B

Drum roll please…

Add it all up and we’re at $1.319T. Google’s market value is only $1.925T. This leaves Search + Network being worth $606B. Mind you, Search + Network will generate $96B of operating profit next year (pre-tax). That implies Search + Network are trading at a multiple of - drum roll pleasssssssssssssssssse → 6.3X.

Alternatively, if you put a 15 multiple on Search operating profit you get $1.44T of value → combine that with the rest of it and we get an enterprise value of $2.759T, about 43% upside from here.

Closing thoughts

I don’t really think an SOTP is useful for purposes of setting a price target. What it is useful for is realizing how diversified Google is. Whatever assumptions you want to use, it seems hard to envision a scenario where Search is being attributed much more than half of their market cap - and a proportion that is shrinking with time.

If we reversed the activity we just did, put a 15X multiple on Search operating profits to get a $1.44T valuation - then we come up with only ~$485B of value for Cloud, Waymo, YouTube, DeepMind, Android + Hardware, and don’t forget the $123B of net cash. That seems ridiculous.

We haven’t even discussed the inherent optionality in things like the fact that Google has better data center technology than anyone on Earth (probably by a long shot). They can “deliver intelligence” more cheaply than anyone. They have the most advanced in-house chip business for AI.

It really is wild to me that people perceive Google as being a potential loser from AI. ANYONE could be a loser…But Google does not deserve some sort of special discount relative to other companies because it is more susceptible. If anything - it is less susceptible and deserves a premium.

Ben, great post! Thank you.

Reposting from X since I think you're focusing on Substack:

A few questions and thoughts based on an initial read:

RE: Youtube - When you use Netflix's valuation, would it make more sense to value YT subscription revenue (~$14bn est.) at the $NFLX multiple (since its stickier, subscription based) and then apply some ad-supported multiple to the YT ad revenue (ie. a $META type-multiple)?

YT also has YoutubeTV which I've seen estimated at ~8 million users now paying $83 per month. The margins on this business are probably quite modest due to content cost (teens? but just guessing). That's ~$8 billion of subscription revenue that would attract a very low multiple, even though it makes YT better and scarier to incumbent cable TV.

RE: Waymo - Has anyone done a simple single car unit economics?

A car has a fixed cost, known depreciable life and operating cost per mile (no one wants to ride in a 150k mile taxi?) Add on the estimated cost of Google's sensors and assume modest operating (compute) costs.

Then just need to know the avg. Waymo fare-per-mile and the key variable becomes utilisation, but 100% provides the upper bound.

Also different possible models of WaymOS licensing (royalty) vs. Owned and operated (above), but would be clearer to understand the actual unit revenue potential, even if long-term margins are unclear.

RE: AI-sistant - Is it possible that Google makes the AndroidOS integrated voice-based Gemini Agent (Siri) so good, so fast, that it becomes a must have feature and $AAPL falls far enough behind that they have to license it or allow it on the iPhone?

RE:Valuation.

Agree SOTP shows a fair degree of Google $GOOG undervaluation.

Another framing is that given an undemanding starting multiple (<20x trailing P/E), it's possible to simply underwrite the EPS growth rate as an expected return without any revaluation.

Each of the dimensions you outline, ignoring Search ads (which are also probably still growing, but economically sensitive), especially Cloud, provide a high degree of certainty of a continued strong EPS growth rate, unless search ads truly dry-up and turn negative.

Would be interested to see you turn the analysis into a range of possible EPS growth rates / scenarios.

Much appreciated!

Great article!